CONCOR: A Long Term Play

- Feb 7, 2022

- 7 min read

The quest is to find a company in India that can compound money in a long term basis. The idea is to find a market leader who has the pricing power and are critical in India's growth story. The business that I am going to write about today usually has a premium to it and is not cheaply priced. Buying high has its own downside risk, but I like the long term potential more. I don't see that I would be requiring any of my investment in this business back in a short or medium term basis, hence I wish the stock may go down by 50% in near term so that I can accumulate more:)

Logistics in India would play a crucial role in how the trade segment is developed over the next few decades. If we think manufacturing is going to be India's growth driver, a highly efficient logistic network would be the engine to support it. Indian logistic segments evolution will be the new sunrise area in its growth story. Lets take a look at the stock now...

Container Corporation of India(CONCOR):

CONCOR started as a company out of Indian railways in 1988 with control of 7 ICDs(Inland Container Depot). ICDs are terminals which perform Container Freight Services (CFS) activities. It's like a junction for containers to load, unload, repair, get custom clearance and perform various other logistic activities. The containers come from ports to the ICDs or to a warehouses before finally getting dispatched to the destination or the other way round. Thats why having the ICDs in strategic locations are the key to success for a logistics business.

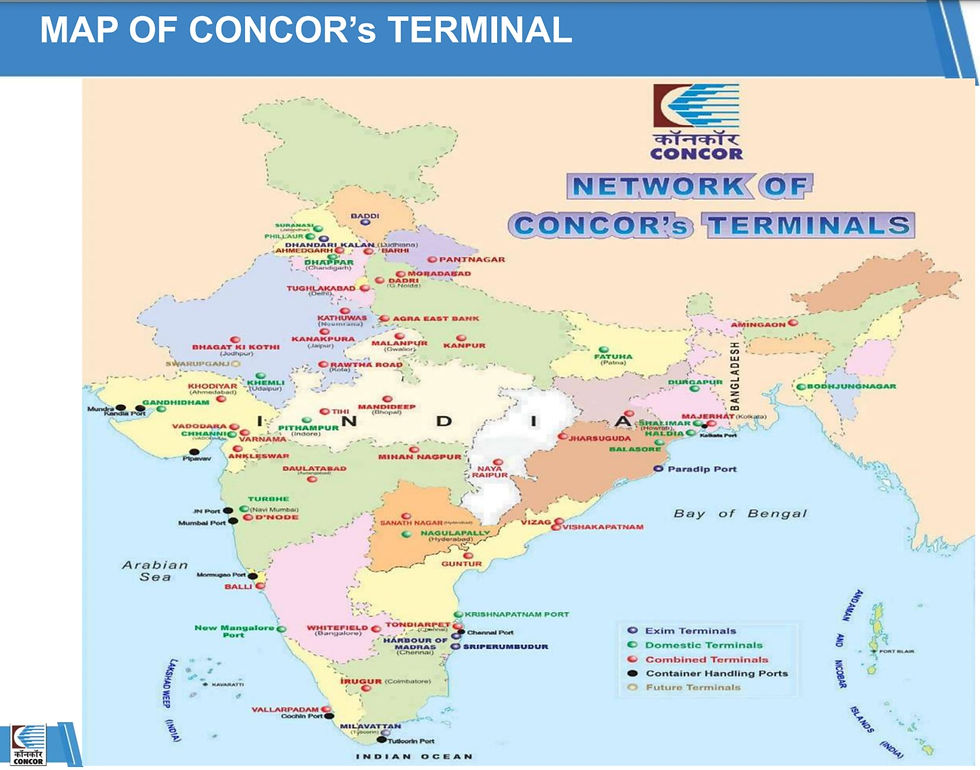

CONCOR is an undisputed market leader in this space. It has more than 60+ terminals across India. Note - The below images are as of March 2021.

A look at the some infrastructure that they have -

They have made a lot of progress in bringing digitalization in this business. Container location tracker, Contract management, Billing, Paperless office, Multivendor management and many other initiatives are online.

CONCOR has around 4 million Sq ft warehouse space and plans to add 21 million sqft warehouse space at strategic locations by partnering with private players. They also have initiated Container as a warehouse to eliminate unnecessary logistics cost to the clients. Addition of containers will only make it more valuable. They are also extending their offering to door to door delivery by taking care of the first mile and last mile road operations as well.

Why do I like this company:

CONCOR is a market leader in rail transport logistics with over 66% market share.

They play a pivotal role in export and import movements as well as in domestic trade

It's a profitable PSU which is debt free.

Government of India is the major shareholder(54.8%) at this point and plans to disinvestment 30.8% stake

Now since there is talk about disinvestment - the Company was asked to pay a rent of 6% based on the current land value every year instead of per container basis. CONCOR & Govt were able to agree on the calculation, so the rent details became clear.(Its around 450 Crores per year, which may vary every year)

CONCOR has taken steps to make it ready for disinvestments -

They have handed over some terminals and portion of land from few other terminals as those locations weren't in alignment with the profit strategy of the company

They currently use 26 terminals of govt out of which they will be handling over 2 more this year as CONCOR is building terminal at those locations by themselves.

They also plan to pay the lease for 24 terminals for 35 years with a loan instead of yearly rent(point 5) and the deal they are planning to strike with the Govt is that they would pay 99% of the current land value for these locations for a lease of 35 years (This is not finalized, the terms may change in future)

The location of the terminals these 24 terminals are at strategic locations which are in alignment with the companies growth plan

They have a reserve of over 2500+ crores, so the plan is to take the rest of the payment as a short term loan. Since they are AA+ rated company, they would be able to secure loan at the cheapest interest rate possible.

They also cleared all outstanding dues, write offs and few one off items last year which ate into their last years profitability. Without these expense they would have been sequentially profitable year on year.

Now with all the above mentioned action and clear details on rent or interest payments on the land lease; it would provide more clarity to potential buyers to work their numbers which has been the objective of the company.

Direction of the company:

With so many changes happening and with an unknown timeframe of the disinvestment process, company is moving ahead with making its operations better. Whether this PSU becomes private or remains under government below operation initiatives will benefit the company.

1) The company is planning to have 60:40 ratio for EXIM vs Domestic from 80:20 and they have already made good progress in that direction.

2) They have completed successful pilots projects for food grains and cement bulk transfers and also have started commercial operations in those areas

3) They believe many of the transfers that currently happens are bagged and if moved to bulk we would save a lot of packing and unpacking costs/materials

4) Road movement of goods will slowly move to rail as the economics are better on rail.

5) Concor also is giving a push to Containers manufacturing in India. They are planning around 8000 containers to be purchased this year.

6) They are developing infrastructure to handle the elevated level of volumes in the future.

7) They have started double stacked operations where possible and also have upgraded their wagons capacity to handle double stacking at many paths.

8) They are constantly enhancing their circuit routes so that minimal empty containers are moving in their network

9) They are a lean organization with only 1400 employees. Mr Kalyana Rama, Chariman and Managing Director has done an incredible job in developing CONCOR to a profitable monopoly.

10) They have an internal target to get to 80% market share.

Historical Returns:

Company has a history of giving bonus to reward shareholders:

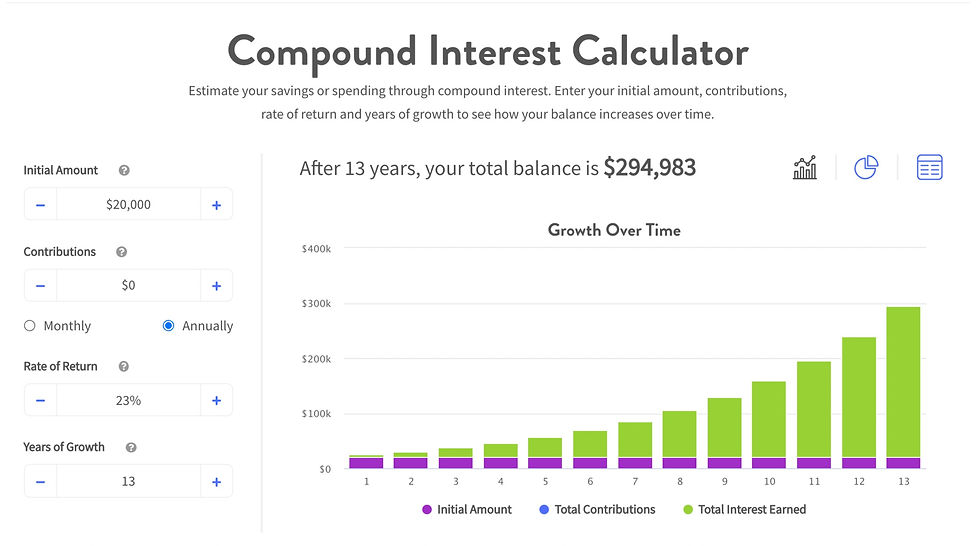

If you had bought 100 shares in 2008(@200) i.e Rs 20000 and held it till now, then your returns would be a total of 468 shares(after split 100 shares would have become 468) * current price 644 = Rs 301392. Thats a rate of return of approximately 23+% per annum. Isn't that an awesome return👌

Below screenshot shows how Rs 20000 compounded for 13 yrs give close to Rs 300000.

Note: The face value of the stock is Rs 5.

Future outlook:

CONCOR is one of the main candidates for disinvestment, hopefully it could play out in next couple of years.

Since the company is already profitable, there will be huge buyers interest. The private entity which takes over pretty much will enjoy the monopoly in EXIM and domestic market share

There will be near term debt on the company to pay for the land leases, but it will play out really well over a long term.

Privatization will bring renewed look at improving profitability, strategic consolidation, synergy and bring digitalization for improved operations

As the infrastructure(Dedicated Freight Corridor(DFCs)) are coming online to support logistics network, better guarantees will be provided on the shipments which will increase shift of more volumes from road to rail.

CONCOR moat will remain for years to come as parallel new entity is almost impossible to build

Valuation and Thesis:

CONCOR was hit by the pandemic/shutdown and fell from approximately Rs 560 to Rs 310 and now trading at Rs 644(100% returns already). The company is hitting best quarters in its history after pandemic and is delivering great results. The disinvestment or privatization should bring value being unlocked in ways thats difficult to comprehend. I would expect the new management to get more value out of this already profitable business.

Its a great business but will it be a great investment, time will tell but I am hopeful of the prospect and the growth story. As indicated earlier, I am building my position and would love to see this fall like 50% to add more, I would be adding more as and when I like the price. I see its at 134th position in terms of market cap in Indian business and its about 40,000 crores(i.e 5B to 6B dollar market cap) - Given the growth of India in decades to come, this will be a business that may flourish in ways we cant imagine.

CONCOR official video - https://www.youtube.com/watch?v=YrqcaV8paZ4 beautifully explains its business.

Disclosure: I/we have a beneficial long position in the shares of CONCOR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This writing is for educational and informational purposes only. All opinions expressed herein are not investment recommendations, and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. Any projections, market outlooks or estimates herein are forward looking statements and are based upon certain assumptions and should not be construed to be indicative of actual events that will occur. This article is not an investment research report, but an opinion written at a point in time. The author's opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information, and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein. Any and all opinions, estimates, and conclusions are based on the author's best judgment at the time of publication, and are subject to change without notice. The author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials. Past performance is no guarantee of future returns.

Comments