Significance of "The rule of 72"

- May 10, 2021

- 2 min read

Rule of 72 is an easy and a quick way to calculate time required to double your money on a compounding account without using the logarithmic calculations. Its a quick and dirty way to calculate the time required to double your investment based on the offered rate of return.The way its calculated can be understood by an example.

Example:

Imagine if you have $10000 to invest and are deploying the money in a compounding investment, then in order to understand how much time will it take for you to double you money($20000) will depend on the rate of return and can be easily calculated using the rule of 72.

Parameters used in the calculation :

Constant number 72

Required Interest Rate

Time in Years

Use number 72 and divide it with Required Return Rate to get time.

72/Required Return Rate = Time in years

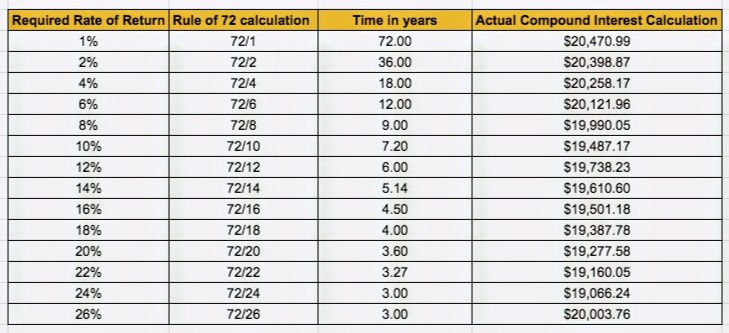

Below are the numbers based on this quick and easy method. Initial Investment is considered as $10000 for the below table.

Note: Actual compound interest amount is also added for your reference.

If your rate of return on invest is 1% , then it will take 72 yrs for it to double and you can easily calculate by doing 72/1.

If your rate of return on invest is 2% , then it will take 36 yrs for it to double and you can easily calculate by doing 72/2.

and so on...

Initial investment capital amount is not of importance in "Rule of 72" calculations (We have not used $10000 in any of the above calculation, this rule applies for any capital).

You can notice a small change in interest rate can have a huge effect on the number of years it might take to get to a double there by impacting your yearly returns. This rule will be very handy in modeling your investment returns on any future potential investments.

Comments